Expert Guidance

Stop leaving non-interest income on the table. Franklin Wells equips you to unlock predictable growth with a focus on optimizing your existing merchant services. We leverage proven strategies, eliminating the need for risky overhauls, and empower your team through personalized coaching and ongoing support. This ensures a smooth implementation, leaving you free to focus on what matters most – achieving your financial institution's goals.

How it Works

Partner Analysis

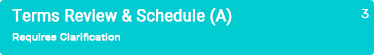

Merchant Services Partnership Agreements

We'll scrutinize your Schedule A, referral/agent agreements, marketing and service terms, exclusivity clauses, and potential hidden risks.

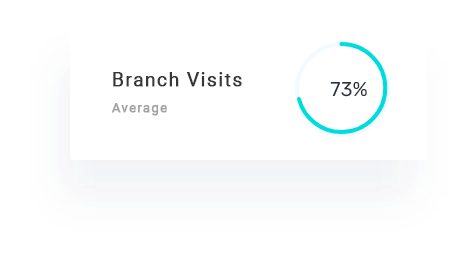

Sales Strategies

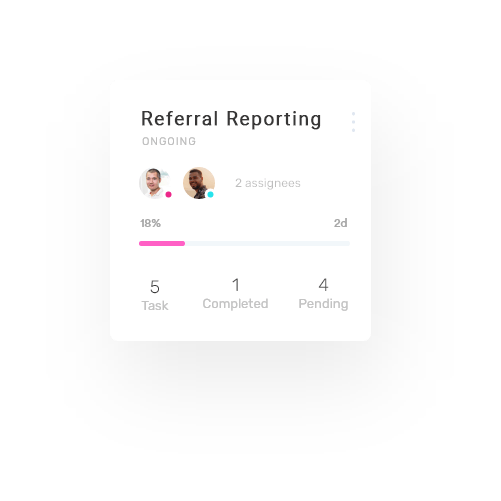

Overall Program Performance

We'll analyze key metrics to identify areas where you can optimize your offerings and maximize revenue generation.

Game Plan

Achieve Your Vision: A Personalized Roadmap to Non-Interest Income Growth.

Franklin Wells goes beyond generic plans. We collaborate with you to define your aspirational 12-month goals, encompassing revenue targets, service level enhancements, and improved NPS scores. Then, we engineer a customized roadmap, meticulously outlining every step needed to achieve these goals. This comprehensive strategy includes:

Leverage our expertise to secure optimal terms within your existing partnerships.

Implement tactics to enhance your sales team's effectiveness and drive revenue generation.

Develop targeted promotions to incentivize merchant services adoption and increase customer engagement.

Our experts will work with your partner for seamless joint calls, converting more leads into high-value partnerships.

Implement data-driven A/B testing to optimize your offerings and maximize revenue potential.

Identify and capitalize on strategic cross-selling opportunities, increasing overall client value.

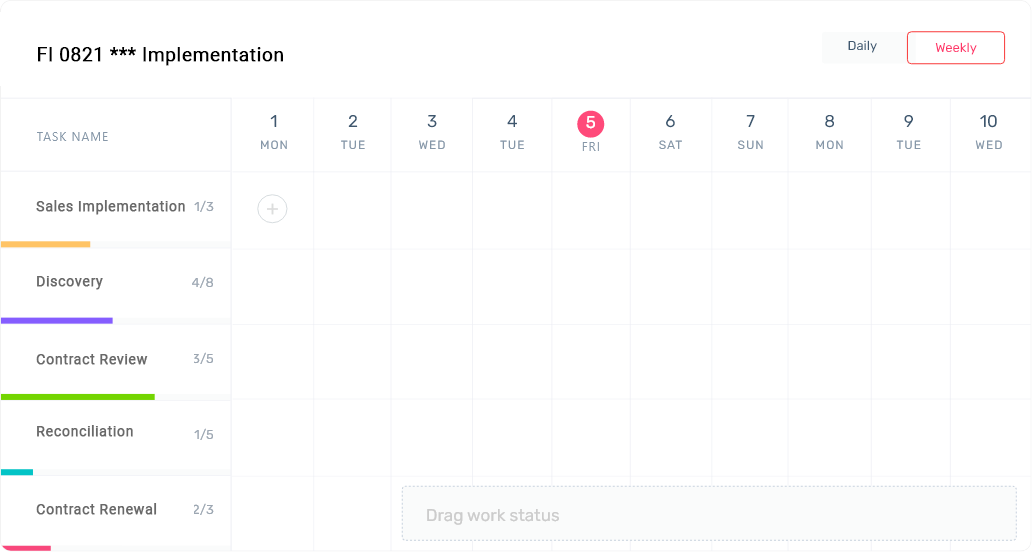

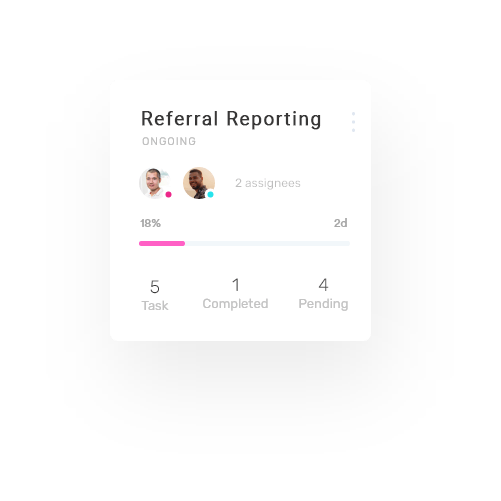

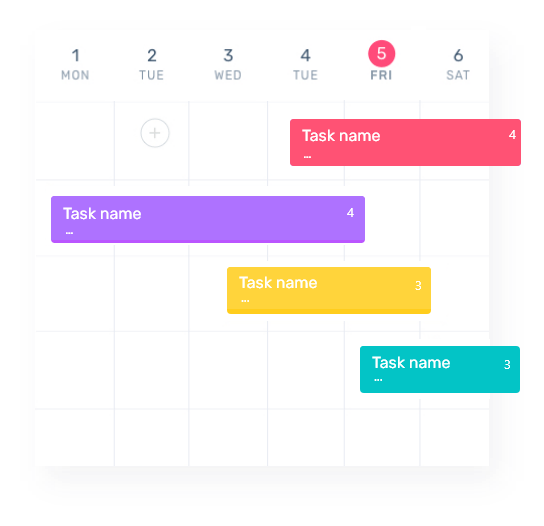

Implementation

Seamless Implementation with Ongoing Expert Support.

Franklin Wells empowers you to execute your plan with confidence. We provide unlimited on-demand access to our team of specialists, ensuring you receive the guidance you need, when you need it. Whether you prefer a quick Zoom call or a detailed email exchange, our experts are readily available to address questions, overcome roadblocks, and keep your momentum high.

Expert Guidance

Leverage the Expertise You Deserve. Our Team, Formerly on the Other Side of the Table, Now Empowering Your Success.

URGENCY

It has never been more important for an FI to increase the non-interest fee income as it is today.

0m+

Volume

0k+

MIDs

0m+

TX's

Interest rates are rising. As interest rates rise, banks' net interest income (NII) will decline. This is because banks typically make money by lending money at a higher interest rate than they pay on deposits. When interest rates rise, the spread between these two rates narrows, which reduces NII.

Rena Shiffman

FI Partner, 64 Branches

Competition is increasing. The banking industry is becoming increasingly competitive, as new entrants such as fintech companies offer a wider range of services at lower prices. This is putting pressure on banks' traditional sources of income, such as NII.

Tad Erikson

FI Partner, 32 Branches

Regulatory changes. Regulatory changes, such as the Durbin Amendment, have limited banks' ability to generate revenue from interchange fees. This has also contributed to the decline in NII.

Cheryl Anne Fernandez

FI Partner, 7 BranchesFAQ

Frequently Asked Questions

Franklin Wells is a coaching program that analyzes your current merchant services partnership and helps your FI optimize the agreement, schedule (A), revenue share percentage and makes sure that you are getting the proper residuals that you are entitled to.

In addition, we may also offer select FI's the opportunity for us to help manage the partnership and program as an ongoing service that makes it nearly impossible to fail at increasing your non-interest fee income.

We focus in on everything related to the merchant services offering from the FI. It doesn't matter if it is an agent, ISO, or referral partnership. We offer all services required to optimize the partnership communication, strategies, revenue share and sales production.

Our services can be project based or performance based. No two FI's are identical and neither are their revenue goals or market conditions. After the initial consultation and due diligence, we will be able to provide a not-to-exceed cost estimate before beginning any work. No one likes surprises, so we work with our clients to understand their specific business needs and then outline our plan of action and the associated costs to implement those solutions.

Long standing partnerships are reason that we started this business. Often, the strategies and methods that were put in place were based on the best possible option at that time of implementation. We offer an outside point of view of what we see works and what is possible. In addition, our partner is the FI, therefore our interests are aligned with the FI and this often means coaching on holding the vendor accountable and negotiating terms that are more favorable for the FI or better service for the account holders.

We specialize in payment processing / merchant services. There are other programs where we have experience, but we know what we are the best at.

Absolutely. The initial consultation is an important part as it helps the FI and us to determine if, and how, we can best work together. We will never try and sell an FI on one of these calls. This call is an open dialogue for transparency, discovery and learning.

The main focus is optimizing the payments partner and program that is already in place for the FI to increase non-interest income and the experience for their account holders.

We work with FI's of all sizes, ranging from single branch locations to 100+ branches.

In today's post COVID era, we are able to serve all 50 states via digital communications. However, there are cases where travel may be requested such as contract renewal negotiations or sales trainings. In these cases we do our best to make ourselves available.